Stuart BarrowcliffUnderwriting Manager, Political Risk, Credit & Bond, AXA XL

June 24, 2022

Innovative financing eases debt while funding ocean conservation

AXA XL’s political risk team plays supporting role in Belize deal

4 minutes

Original Content: AXA XL

An innovative award-wining public/private-sector program is enabling Belize to restructure its sovereign debt and fund marine conservation projects. The program – the largest of its kind so far – combines development finance with private political risk and credit insurance to help the Central American country reduce its debt burden, while taking a quantum leap toward sustainable economic growth.

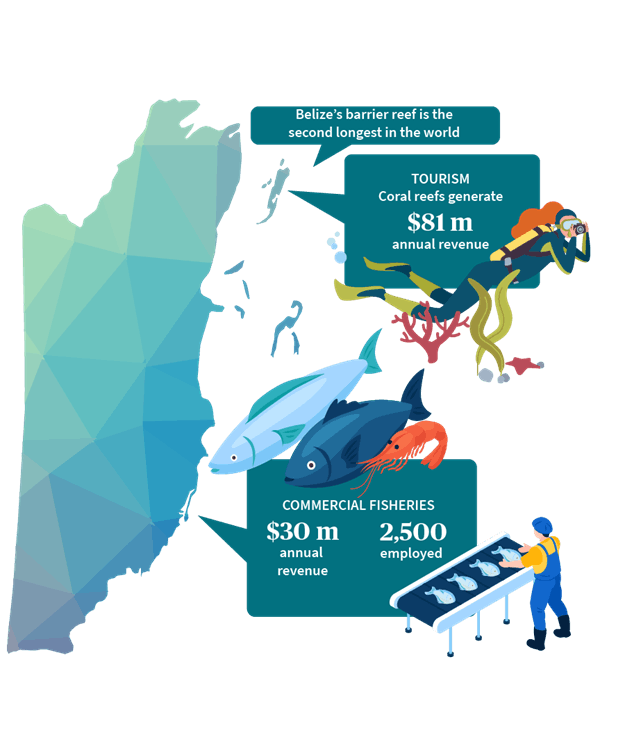

Belize is a small but fast-growing nation bordering the Caribbean Sea between Mexico and Guatemala. Blessed with abundant marine resources and highly dependent on tourism, Belize boasts the second-longest barrier reef in the world. A complex set of reefs and offshore structures makes Belize a top destination for many recreational scuba divers. For example, the Blue Hole, a large ocean sinkhole in an atoll about 62 miles from the mainland, is one of the most popular diving sites in the world. The Belize Barrier Reef Reserve System was named a UNESCO World Heritage Site in 1996, recognizing the barrier reef’s biodiversity and cultural significance.

Like many developing countries, Belize has a high level of foreign debt. In 2022, its debt-to-gross domestic product (GDP) ratio was estimated at 113%. Servicing that debt and meeting the needs of its more than 405,000 citizens unfortunately leave little capital left to invest in protecting and sustaining natural resources.

In late 2021, the U.S. International Development Finance Corporation (DFC), in partnership with The Nature Conservancy and Credit Suisse, agreed to insure a new loan enabling Belize to reduce its debt burden and generate funding for expanded marine conservation through Blue Bonds for Ocean Conservation.

A critical element of the financial structure for this project is AXA XL’s participation in collaboration with other private political risk insurance companies which allowed this loan to achieve an investment-grade rating.

How the program works

Under the program, Credit Suisse arranged a new loan of $364 million to fund Belize’s repurchase of $553 million of existing sovereign debt that was then replaced new debt and resulted in an overall all sovereign debt reduction of $250 million and created $180 million in funds over the next 20 years for ocean conservation projects. DFC is underwriting primary political risk insurance for the loan, supported by $610 million of facultative reinsurance from AXA XL and others, covering principal and interest nonpayment under the newly issued Belize sovereign debt. Meanwhile, The Nature Conservancy is facilitating a stakeholder-driven marine conservation plan that will protect about 30% of Belize’s coastal waters, including coral reefs and fisheries. A portion of the funds also will be used to establish an endowment for future conservation projects beyond 2040.

The benefits of this partnership are many-fold, not only in the short term but also longer term. By restructuring its outstanding debt, Belize gains immediate relief from a high debt-service burden. In addition, the blue bonds

will triple the country’s budget for marine conservation programs during the next two decades. Protecting Belize’s coastal resources will enable it to sustain its tourism-based economy and reduce the impacts of climate change. Finally, and perhaps most significantly, the successful implementation of this transaction is another important demonstration of the viability of this concept.

This kind of public/private partnership for marine conservation was first implemented successfully in 2016, spearheaded by The Nature Conservancy in the Republic of Seychelles. These programs are models for future environmental protection and financial support for developing economies – and creative funding solutions to improve sustainability and resilience. According to The Nature Conservancy, the ocean contributes $3 trillion per year to global gross domestic product. Marine conservation is one of the United Nations’ Sustainable Development Goals, but it remains one of the most underfunded.

About the Author

Stuart Barrowcliff is Underwriting Manager in AXA XL’s Political Risk, Credit & Bond team. He joined XL, now part of AXA, in 2011, where he was a senior underwriter. His career experience includes various executive roles with other insurance organizations and financial institutions. He has a master of arts degree in international economics and Latin American studies.