November 24, 2020

Green bonds: How active management aims to make the most of a dynamic sector

The market for financing linked to environmentally friendly projects and companies is heading rapidly towards the $1trn mark[1]. News that the European Union is exploring plans to sell €225bn of green bonds[2] adds fresh impetus, and comes after the market had already hit records in 2019 by every measure – more issuance, more issuers, more deals, more volume than ever before[3].

6 minutes

Original Content: AXA IM

It’s not only in Europe where the political and regulatory environment looks supportive. The victory for Joe Biden in the US Presidential Election drew a stream of messages from world leaders emphasising the need to work together to tackle climate change. Biden has committed to rejoining the Paris Agreement, which the US formally left only in early November.

There is, in our view, a gathering momentum – and a growing awareness that climate change is a threat to our economic well-being. The green bond market has emerged as a potentially crucial part of addressing that threat. In our view, it is one of the most dynamic areas in our evolution towards a sustainable global economy, and we believe can reward in-depth active management as investors seek genuine financial returns, alongside genuine environmental impact.

A more varied sector

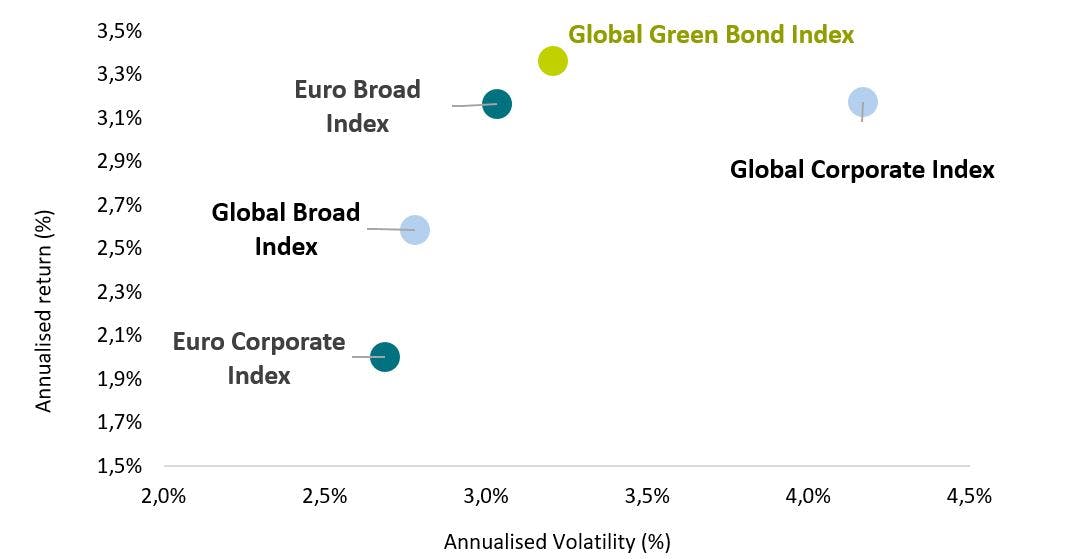

The green bonds universe has evolved a lot, moving from a focus on Sovereign-related issuance and a few utilities, towards a well-balanced mix that draws in far more diversified sources of credit. Crucially, active management can enable us to adapt to the pace of market changes and potentially allow us to aim for a consistent risk-return profile over time. It is worth noting that through those changes, on a three-year view, green bonds have maintained relatively attractive risk-adjusted returns, as shown in the chart below.

Measuring green bonds' risk-adjusted returns over three years

Source: Intercontinental Exchange, BofAML indices (GBMI, GREN, G0BC, ER00 and EMU0). Calculations to 31 October 2020.

The sector was noteworthy for its resilience as the COVID-19 crisis hit at the beginning of 2020. That was helped by the fact that utilities still have a larger weight in green bonds than in conventional credit. Coupled with a long duration profile, reinforced by recent long-dated sovereign issuance, this defensive profile has been beneficial. That’s not the whole story, however, and an investor might like to be able to ensure an optimal allocation across every market cycle.

That means having the agility to allocate actively between the most defensive/expensive parts of the universe when needed, and its most attractive, higher yield parts when opportunities arise. In the present low interest rate environment, as income return diminishes, the ability to benefit from price movements across these different segments is key to generating returns.

Joining the party

Recent growth in the green bond market has been driven by an influx of inaugural issuers, a trend that has helped to address the concentration issue which was a concern for investors some years ago. In 2019 issuance climbed by more than 50% year-on-year, up from $171.2bn to $258.9bn – a new market high – while the number of issuers went from 347 to 506, according to the Climate Bonds Initiative[4]. But this is still a far from conventional universe. It remains uneven, innovative and exciting – a place where we believe active management is needed to ensure broadly balanced issuer selection and to avoid any unwanted bias.

One of the many records the green bond market sets every year is the volume of primary issuance. In 2020, with all the obstacles in our path, we passed 2019 levels in October. That means that access to the primary market is key when managing green bonds as it provides liquidity and avoids the additional transaction costs in the in the secondary market that would be faced with a passive/exchange-traded fund (ETF) approach.

Delivering impact

One crucial question that emerges when investors consider green bonds centres on how they can be sure what is green and what is not. The market may be growing every year, but regulation has not yet emerged that allows for entirely consistent definitions of environmental goals and parameters. Again, an active approach is crucial to ensure the selection of credible green bonds across the universe in a way that is transparent and straightforward for clients. We believe it is important for large players in this market to not only enjoy the potential financial returns, but to ensure we support truly meaningful environmental projects from companies whose strategies are aligned with the energy transition.

In the absence of a real consensus around the regulation of the green bonds market, there can be a lack of clarity around some issuance. Not every issuer, for example, commits to provide annual impact reporting with quantitative impact metrics. But in our view, it is impossible to deliver true environmental impact through investing in green bonds unless you can report and measure it.

An active approach can enable investors to focus on issuers that provide the most transparency about the projects they finance and about their potential impacts such as, among others, tonnes of CO2 avoided, renewable energy installed capacity, water treated and waste recycled. This kind of information allows investors to understand the true nature of green bonds, to know precisely how their money is financing a change and by how much it is contributing. This is a fundamental aspect of green bond investing that a passive approach would simply miss.

Active, and engaged

To truly be a part of the energy transition demands more than simply buying green bonds. Our deep commitment to the stewardship of assets we own extends across our investments and helps to keep us close to the heart of the green bonds market. We think it makes sense to maintain a continued dialogue with existing and potential issuers about how they might start, continue or increase their commitment according to their specific economic activity.

Our analysts have met with close to 90% of the issuers we hold in our green bond’s strategy, making sure our voice is heard while helping companies adapt. More broadly, our membership of the green Bonds Principles Executive Committee[5] affords AXA IM and its clients a voice in the push for industry guidelines to improve transparency and disclosure. We also think it is important to keep closely monitoring the market, to reward issuers with allocations when they improve their standards, or to review investments which fail to meet our standards on environmental commitment or transparency.

Putting it to work

Our green bonds strategy aims to deliver a positive impact alongside financial returns by investing exclusively in bonds from issuers with a clear environmental strategy and meaningful projects. So how can asset managers make sure issuers meet those standards when building a strategy?

Before assessing the credibility of a green bond issuance, we first filter the universe to remove any possible controversial activity, sector, or issuers that could be associated with poor environmental, social or governance (ESG) practices. Our strategy applies AXA IM’s sectoral policy as well as its climate policy while relying on our proprietary ESG scoring system[6] to identify poor ESG issuers.

But what really makes the difference is our proprietary green bond Framework[7]. This is the tool with which we seek to overcome the lack of common measures in the market, by setting clear and consistent standards which issuers – and clients – can understand. The framework is the engine for our active strategy.

It is designed to deliver an over-arching assessment of each bond under consideration and aims to ensure projects earmarked for funds by a company reflect a wider commitment to tackle climate change. We assess the issuer’s sustainable strategy, the demonstrable environmental benefits of the projects to be financed, the management of the bond proceeds and the issuer’s impact report. The framework also demands a high level of transparency.

This combined approach refines the investment universe to strip out about 25% of issuers. The goal is to minimise the risk of green washing

while building a diversified strategy that avoids extreme

positioning and ensures consistency over time.

Transparency is vital from our side too. We believe a green bond strategy must be able to measure and report its environmental benefit to investors. This is why we produce a monthly impact report that includes specific indicators – such as emissions avoided – as well as details of the environmental projects financed. We also map investments to the UN Sustainable Development Goals.

It is impossible, we think, to deliver this depth of management without an active approach. Since the launch of our green bonds strategy we have sought to be a pioneer and a benchmark for the sector, taking care to burnish its credibility and support its growth. Only with high standards, careful research and a commitment to good stewardship can we genuinely limit concentration risk, weed out controversies, prevent ‘green-washing’, improve access to the primary market and shape the nature of issuance. By doing all this, we believe an investment manager should be able to generate more attractive returns and limit downside, while delivering genuine impact in the fight to take on the challenge of climate change.