9M23 Activity Indicators

- download

Press Release

PDF 441.7 KB

- press contacts

November 2, 2023

published at 5:45 PM CET

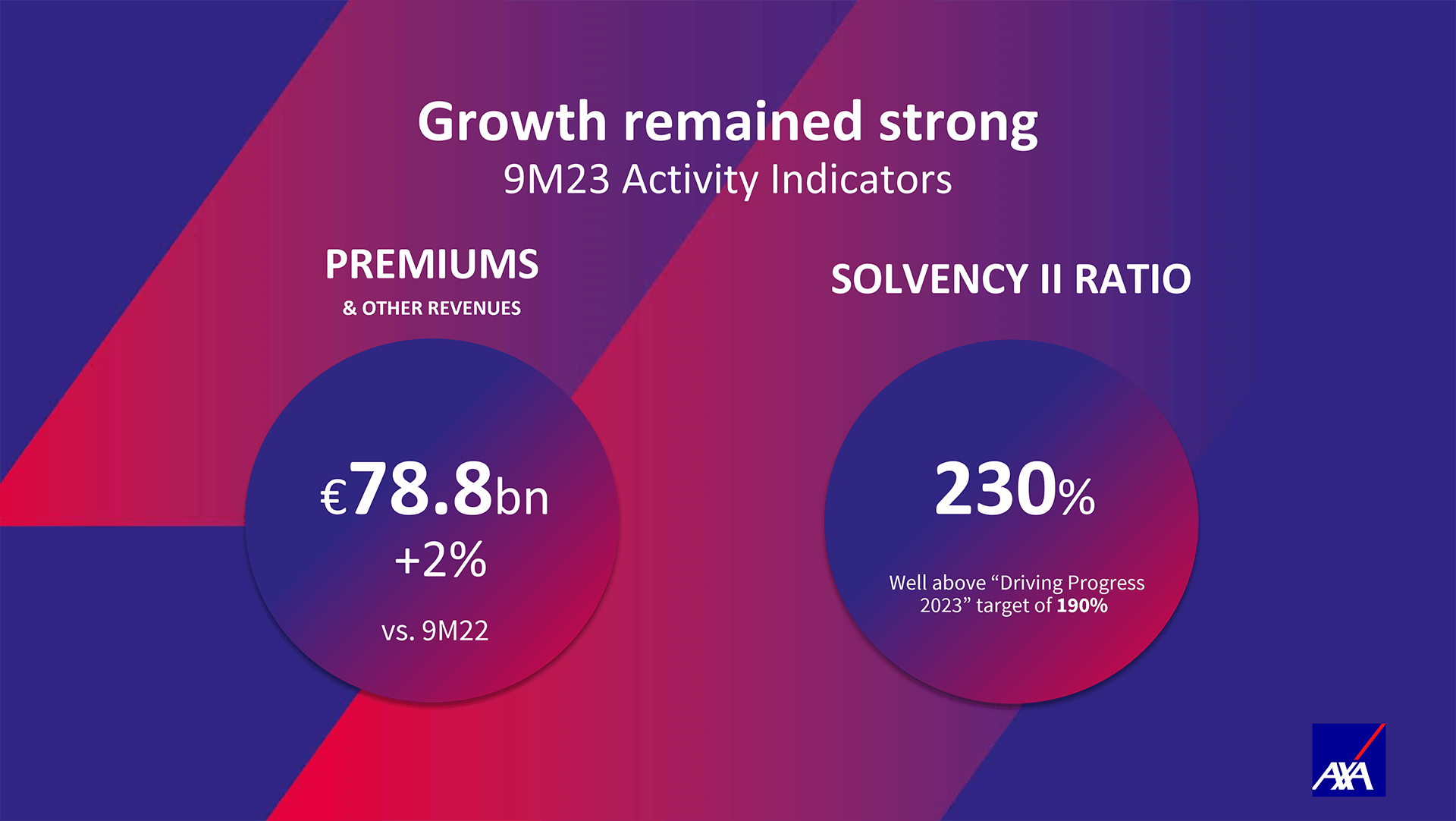

- Gross written premiums and other revenues* up 2% to Euro 78.8 billion

- P&C Commercial lines** premiums up 9% to Euro 25.8 billion

- P&C Personal lines premiums up 5% to Euro 13.9 billion

- Protection premiums up 3% to Euro 11.5 billion - Solvency II ratio*** at 230% down 5 points vs. 1H23

Alban de Mailly Nesle

Group Chief Financial Officer

AXA achieved another very good performance in the first nine months of 2023. Revenue growth remained strong with good momentum in our technical and cash generative lines and across our two Commercial and Personal pillars.

In P&C Commercial lines, which is our largest business, premiums were up 9% benefiting from good customer demand and disciplined pricing. In P&C Personal lines, we saw continued repricing with overall premiums now up 5%. Life & Health revenues were again of high quality with good organic growth across Protection, Capital-light G/A**** business and Health, although the environment remained challenging for Unit-Linked. The right-sizing of our non-prioritized businesses is now almost complete across Property Catastrophe Reinsurance, traditional G/A Savings, and some Group Health international contracts.

Our model continues to deliver strong capital generation. AXA’s Solvency II ratio stood at 230% at the end of September, in particular reflecting our decision not to refinance over Euro 1 billion in subordinated debt.

Alban de Mailly Nesle

Group Chief Financial Officer

In line with our strategy, we continue to focus our footprint on our core markets where we have leading positions, while exiting non-core markets. The Group recently finalized the acquisition of Laya Healthcare, strengthening our leadership in Ireland, and agreed***** on the disposal of its joint venture Bharti AXA Life Insurance Co in India. We also remain confident in delivering our in-force management target****** by year-end.

The Group is on track to achieve its earnings outlook target for the year and fully deliver on its four main

Driving Progress 2023financial targets*******. AXA is in a position of strength ahead of launching its new Strategic Plan, which will be communicated on March 11, 2024.I would like to thank all our colleagues, agents and partners for their commitment and support, as well as our clients for their continued trust.

* Change in Gross Written Premiums & Other Revenues, New Business Value (NBV

), Present Value of Expected Premiums (PVEP

) and New Business Value Margin (NBV Margin

) is on a comparable basis (constant forex, scope and methodology), unless otherwise indicated.

** Commercial lines

refers to P&C Commercial lines excluding AXA XL Reinsurance.

*** The Solvency II ratio is estimated primarily using AXA’s internal model calibrated based on an adverse 1/200-year shock. It includes a theoretical amount for dividends accrued for the first nine months of 2023, based on the full-year dividend of Euro 1.70 per share paid in 2023 for FY22. Dividends are proposed by the Board, at its discretion based on a variety of factors described in AXA’s 2022 Universal Registration Document, and then submitted to AXA’s shareholders for approval. This estimate should not be considered in any way to be an indication of the actual dividend amount, if any, for the 2023 financial year. For further information on AXA’s internal model and Solvency II disclosures, please refer to AXA Group’s SFCR as of December 31, 2022, available on AXA’s website (www.axa.com).

**** General account.

***** The completion of the disposal is subject to customary closing conditions, including the receipt of regulatory approvals.

****** Euro 30-50 billion of life in-force reserves ceded, to be announced by 2023 year-end.

******* Including the Group’s expectation to exceed underlying earnings per share CAGR 2020 rebased-23e target of 3%-7% and 2021-23e cumulative cash remittance target of Euro 14 billion under Driving Progress 2023, based on normalized natural catastrophe charges and assuming current operating and market conditions persist. Including the Group’s expectation to exceed underlying earnings per share CAGR 2020 rebased-23e target of 3%-7% and 2021-23e cumulative cash remittance target of Euro 14 billion under Driving Progress 2023, based on normalized natural catastrophe charges and assuming current operating and market conditions persist. For the purposes of the underlying earnings per share CAGR target, FY2020 underlying earnings rebased includes actual underlying earnings restating for Covid-19 claims

and natural catastrophes in excess of normalized. AXA Group normalized level of expected Natural Catastrophe charges for 2020 set at ca. 3% of Gross Earned Premiums. Natural Catastrophe charges include natural catastrophe losses regardless of event size. Covid-19 claims

include P&C, L&S and Health net claims related to Covid-19, as well as the impacts from solidarity measures and from lower volumes net of expenses, linked to Covid-19. Covid-19 claims

does not include any financial market impacts (including impacts on investment margin, unit-linked and asset management fees, etc.) related to the Covid-19 crisis.

Find out more

Contacts

Investor Relations

Investor Relations team

Media relations

Axa Media Relations