Jarek KlimczakSenior Risk Consultant, Marine, AXA XL

24 juin 2022

Gérer les risques dans une mer de changements : La transition de l'industrie maritime vers les biocarburants

Afin de minimiser les risques potentiels liés au changement climatique, les industries de tous les secteurs économiques prennent des mesures pour réduire les émissions de carbone dans le but d'atteindre la neutralité carbone. L'industrie maritime ne fait pas exception.

9 minutes

Contenu Original: AXA XL

Many countries and companies are following the emissions targets set by the Paris Agreement. Adopted at COP21 in December 2015, the Paris Agreement is the first universal and legally binding global climate agreement that establishes a framework to avoid dangerous climate change by limiting global warming to well below 2°C and pursuing efforts to limit it to 1.5°C compared to pre-industrial levels.

Industry initiative

The Agreement, however, did not specifically include the shipping sector. Instead, to set its own emission targets, in April 2018, member states of the International Maritime Organization (IMO), a specialized agency of the United Nations responsible for regulating shipping, adopted its initial Green House Gas (GHG) strategy. The strategy recommended that GHG emissions from international shipping peak as soon as possible and that the industry must reduce its total annual GHG emissions by at least 50% of 2008 levels by 2050, with a strong emphasis on zero emissions. This strategy essentially aligned emissions from shipping with the Paris Agreement.

This Initial Strategy aims to help the marine industry:

- Reduce the total annual GHG emissions by at least 50% by 2050 compared to 2008 (

the IMO Absolute Target

) - Reduce CO2 emissions per transport work by at least 40% by 2030, pursuing efforts towards 70% by 2050 compared to 2008 (

the IMO Intensity Targets

).

A heavy load

Like many industries, in striving to reach their emission reduction goals, marine operations face some considerable, yet not undauntable, challenges.

For one, maritime shippers support up to 80% of global trade and accounts for 2-3% of global GHG emissions annually, emissions that are comparable to large economies such as Germany and Japan, according to the World Economic Forum.

And global trade certainly isn’t slowing down. In fact, according to the Global Trade Update from the United Nations Conference on Trade and Development (UNCTAD), the value of global trade reached a record level of $28.5 trillion in 2021, an increase of 25% over 2020 and 13% higher compared to 2019, before the COVID-19 pandemic struck. If no action is taken, it is estimated that increased activity could increase emissions from shipping between 50% and 250% by 2050.

Alternative approaches

One big recent change that the industry recently implemented was IMO 2020, a rule that went into effect January 1, 2020. It limits the sulphur in the fuel oil used on board ships operating outside designated emission control areas to 0.50% m/m (mass by mass) - a significant reduction from the previous limit of 3.5%. This new limit was made mandatory following an amendment to Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL).

Transitioning to biofuels and other alternative fuel mixes is another option that is offering the marine industry a fast path to achieving decarbonization and lessening its dependence of fossil fuels.

Biofuels are currently used in both aviation and road transport sectors. Bioethanol and biodiesel have been blended in gasoline since the end of the 1970s. Biobased jet-fuel blends were approved for the aviation sector in 2011. Biodiesel fuel in the marine sector has begun since 1998 when a feasibility study initiated the use of soybean biodiesel for recreational boats in the Great Lakes region in North America.

There are a variety of biofuel options including:

- First generation biofuels refer to fuel derived from crops like starch, corn, sugar cane, wheat, animal fats and vegetable oil to make bioethanol.

- Second generation biofuels include wood, organic waste, food waste and specific biomass crops. These are only made from lignocellulosic crops.

Lignocellulosic crops are mainly hard, woody crops. Currently, there is limited application of this type of biofuel in shipping. Second-generation biofuels are not yet produced commercially, but a considerable number of pilot and demonstration plants have been announced or set up in recent years, with research activities taking place mainly in North America, Europe and a few emerging market countries such as Brazil, China, India and Thailand. - Third generation biofuels include algal fuel which can yield up to 30 times more energy per acre than land crops like soybeans. Algae can be used to produce vegetable oil, bioethanol, bio-methanol, biobutanol, biodiesel, and other biofuels.

Some hurdles

While biofuels are promising, there are some associated risks. Plant-based biofuel production requires large amounts of land, water and fertilizer and could reduce potential food supplies.

Price is another concern, although, the current price of fossil fuels is expected to rise with a price on carbon and regulatory changes.

Along with production and price of biofuels, another potential challenge is having the right equipment including engines that can burn biofuels. Still a newer source of energy, there is also little long-term data on biofuel application in Marine propulsion.

Several marine companies are taking the lead in testing the potential biofuel use.

Logistics giant Maersk, which was the first major shipping line to pledge to be carbon neutral by 2050, launched trial programs to test biofuel blends. In one, Maersk Supply Service and The Ocean Cleanup partnered to purchase 90MT HVO biofuel (Hydrotreated Vegetable Oil), with the mixing rate set at 15% HVO and 85% Low Sulfur MGO (Marine Gas Oil). According to the Maersk announcement, at this rate and with current fuel efficiency, the HVO was able to cover 2 separate 6-week trips, with a total saving of 38.95 MT CO2. The savings were approximately 90% CO2 on the emissions from the HVO itself – that is, 13.5% of the total.

Recently Maersk announced it will order eight new ocean-going ships that will use only carbon-neutral fuels to hit its net-zero goal by 2050. The vessels will have a dual fuel engine setup that can run either methanol and conventional low-sulfur fuel.

More recently, French shipping and logistics major CMA CGM launched a pilot program with the support of the Maritime and Port Authority of Singapore (MPA). On February 23, 2022, its vessel, APL Paris, was the first of the group’s vessels to be bunkered with biofuel in Singapore. The 6-month global trial will involve up to 32 containerships running on different blends of biofuel to measure carbon dioxide (CO2) and nitrogen oxide (NOx) emissions to develop a trend analysis.

Operational risks

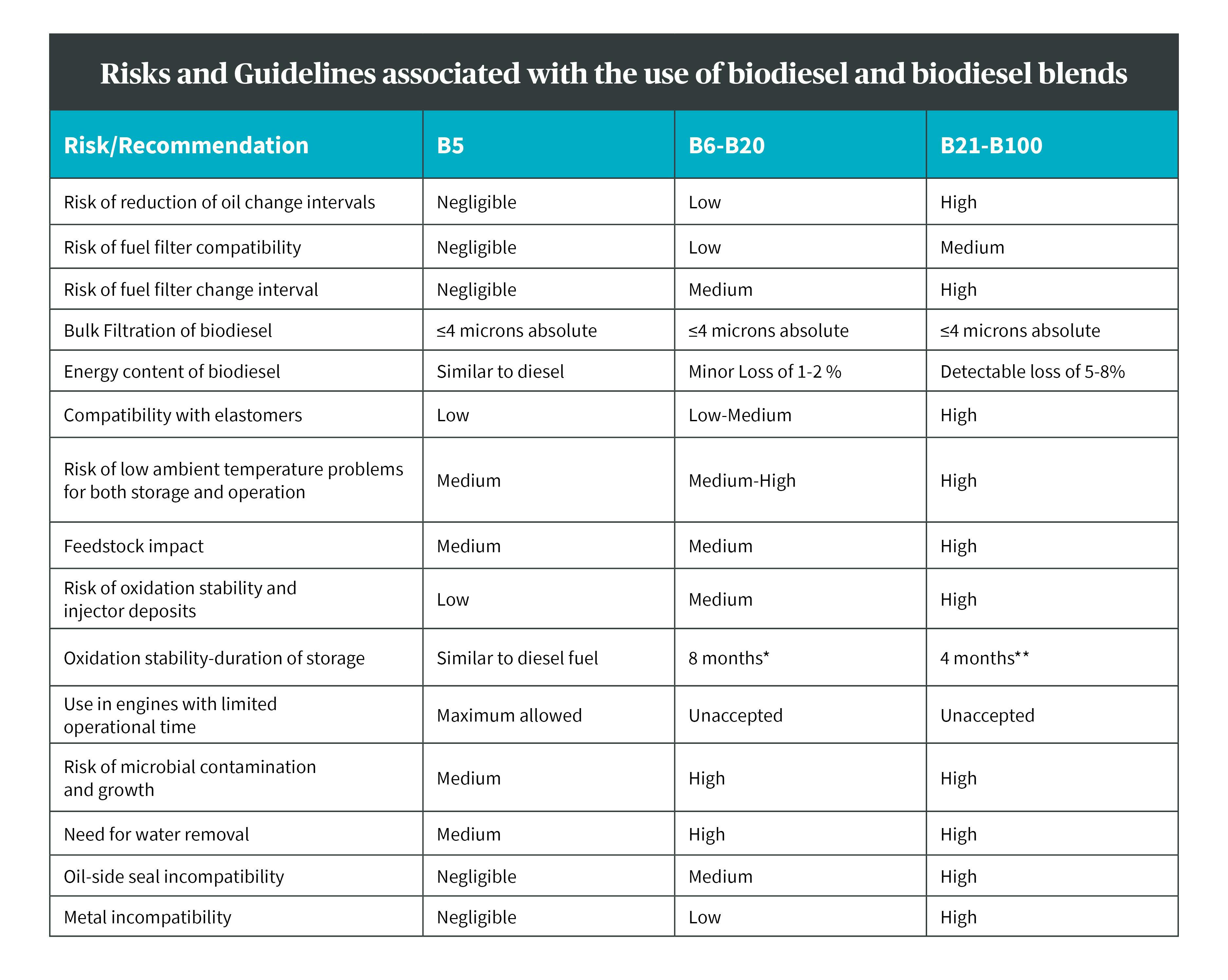

- Microbial growth, excessive formation of sludge, can lead to fuel contamination, clogged or fouled equipment, and if unchecked, even engine failure.

- Oxygen degradation: Deposits in piping and engines could form, compromising operational performance.

- Corrosion: Biodiesel are more corrosive and with higher degradation potential than diesel fuels.

- Possible degeneration of rubber sealings, gaskets and hoses.

- Low temperature: Biodiesels in higher concentration usually have a higher cloud point than diesel (depending on feedstock), leading to poor flow properties.

- Conversion: Biodiesel displays a solvent property different from petro-diesels, so when switching from diesel to biofuel it is expected that deposits in the fuel system will be flush, dissolved and may potentially clog fuel filters. It is recommended to flush the system and/or to monitor filters during this period and change them shortly after switching to the blends.

- Limited expertise within the shipping sector for handling of some biofuels, and lack of long-term fuel test data to guarantee the safety and continued reliability of the selected fuel. Most of marine engine manufacturers give conditional warranty against the use of biodiesel in the engines (engine makers position may vary) due to different characteristics of combustion.

- Lack of regulatory standards: ISO marine fuel standard (ISO 8217:2017) did not cover the wide scope of biofuels now offered to the marine market, which may include up to 100% biofuel, and only sets specifications for distillate fuels containing up to 7.0% FAME.

Fueling a ship with biofuel may also require some operational and maintenance considerations. Best practices handling biofuels include:

- Ensure consultation with engine makers: Engine makers need to be consulted beforehand to verify what type of blends can be used with specific type of the engine. Some makers may not offer any extended warranties either in case the biofuels are used or older generation engines are supplied with any type of blends or higher blends, then indicated by the maker, have been used. Shipowners are urged to get confirmation letter from the engine makers, their dealer or supplier explicitly providing specification of biofuels, which may be used in those engines.

- Consideration of ambient & sea water temperature of operating regions: Biodiesels in higher concentration usually have a higher cloud point (refers to the temperature below which wax in diesel or biowax, forms a cloudy appearance in biodiesels) than diesel (depending on feedstock), leading to poor flow properties. The presence of solidified waxes thickens the oil and clogs fuel filters and injectors in engines. The wax also accumulates on cold surfaces and forms an emulsion with water (producing, for example, pipeline or heat exchanger fouling). Therefore, cloud point indicates the tendency of the oil to plug small orifices or filters at cold operating temperatures. It is therefore important to know the product’s cold flow properties and to keep the storage and transfer temperatures above the cloud point.

- Identify availability of biofuels in the region and access to supply hubs, existing infrastructure: Biofuels are not commonly available in every port or region of the world. Therefore, proper analysis of available infrastructure shall be done prior to the decision being made to operate the ships on biofuels within specific geography. Although the vessels would be able to combust traditional fuel, the changeover procedure, maintenance regime and fuel storage capacity on board the vessel may create additional challenges.

- Placing specific testing procedures: ISO marine fuel standard (ISO 8217:2017) did not cover the wide scope of biofuels now offered to the marine market, which may include up to 100% biofuel, and only sets specifications for distillate fuels containing up to 7.0% FAME (fatty acid methyl esters). The ISO committee is working on a draft version of the new ISO 8217 standards, which may be named as (8217:2020) but has not been released yet. The blends with higher content of biofuel are subject to other standards, mainly applicable to automotive industry. In such cases other fuel shall be tested against those standards in addition to ISO 8217:2017.

- Vetting of suppliers of biofuel (vendor management list): Keeping vendor management program is an utmost important tool to receive fuels, meeting specific chemical, physical compositions and kinematic viscosity. A supplier shall demonstrate long presence on the market, existing relation with the buyer and good track record of supplies. Vendor management program monitors trends of supplies in terms of quantity and quality against the test results from the laboratory, to ascertain seamless operation of engines. Any type of opportunistic purchase of fuel from unknown suppliers shall be avoided. In case the supplier is new to the buyer, latter shall make sure to test the fuel after receiving it and not to use any before the results are received from the laboratory. The fuel shall meet contractually agreed specification and quantity.

- Update maintenance regime for ship’s engine for any additional services required: Engines operating on biofuels may be subject to different maintenance and overhauling regimes due to different properties than petrodiesels. Some blends may require more frequent replacement of components, cleaning of tanks, pipelines, filters or use a spare part designed to work with the type of biofuel. The best source of such information will be engine makers and also fuel testing organization. All shall be included in bespoke operating instruction for the engine.

- Training of crew: Ultimately the crew on board will be in charge of operating the ship and her engine. Not only safety but also commerciality of the ship’s operation, especially eliminating any downtimes, are on stake. Therefore, proper training and understanding of limitation of biofuels must be well-known to the crew. Not only limitations but maintenance and some specific properties of blends shall be well known. Human element is one of the most important but last safeguards against misuse of fuels.

Use of biofuels is showing promising results and may have a significant impact in helping the marine industry reach its emissions-cutting goals. Carefully managing the operational risks associated with biofuels will continue to test the viable alternative fuels and will assure that the industry continues to make progress, doing its part to minimize climate change risks.

About the Author

Jarek Klimczak is a Senior Risk Consultant with AXA XL’s Marine insurance business in the Americas. He brings more than 32 years of maritime, logistics, insurance, and risk management expertise to his role. He also has extensive experience within the shipping and logistics industry with a focus on loading security, heavy-lift operations, and towage as well as deep skills in cargo security and risk management.

La version française est une traduction de l’article original en anglais, à des fins informatives exclusivement. En cas de divergences, l’article original en anglais prévaudra.

Global Asset Protection Services, LLC, and its affiliates (AXA XL Risk Consulting

) provides risk assessment reports and other loss prevention services, as requested. This document shall not be construed as indicating the existence or availability under any policy of coverage for any particular type of loss or damage. AXA XL Risk. We specifically disclaim any warranty or representation that compliance with any advice or recommendation in any publication will make a facility or operation safe or healthful, or put it in compliance with any standard, code, law, rule or regulation. Save where expressly agreed in writing, AXA XL Risk Consulting and its related and affiliated companies disclaim all liability for loss or damage suffered by any party arising out of or in connection with this publication, including indirect or consequential loss or damage, howsoever arising. Any party who chooses to rely in any way on the contents of this document does so at their own risk.

US- and Canada-Issued Insurance Policies

In the US, the AXA XL insurance companies are: AXA Insurance Company, Catlin Insurance Company, Inc., Greenwich Insurance Company, Indian Harbor Insurance Company, XL Insurance America, Inc., XL Specialty Insurance Company and T.H.E. Insurance Company. In Canada, coverages are underwritten by XL Specialty Insurance Company - Canadian Branch and AXA Insurance Company - Canadian branch. Coverages may also be underwritten by Lloyd’s Syndicate #2003. Coverages underwritten by Lloyd’s Syndicate #2003 are placed on behalf of the member of Syndicate #2003 by Catlin Canada Inc. Lloyd’s ratings are independent of AXA XL.

US domiciled insurance policies can be written by the following AXA XL surplus lines insurers: XL Catlin Insurance Company UK Limited, Syndicates managed by Catlin Underwriting Agencies Limited and Indian Harbor Insurance Company. Enquires from US residents should be directed to a local insurance agent or broker permitted to write business in the relevant state.

Mots-clés:

Changement climatique